Francogeddon – Uncapping the Swiss Franc – a Signal of Global Consciousness?

Does an organization – and thus ultimately humanity - show some sort of consciousness or self-awareness? One might think so, at least in moments such as on the day when princess Diana died, or more recently, on the day when I was stuck at home in Cambridge while the Boston Marathon bomber was roaming at large in the neighborhood. In those intense moments we feel maybe not “collectively intelligent” but certainly “collectively aware” or “collectively conscious”. If we meet a stranger in those moments, we know what they are thinking, namely “it’s so sad Diana died,” or “where might the marathon bomber be hiding and hitting next”. Moments like these motivate an informal definition of “organizational consciousness”. It is analogous to the human body, where the brain is conscious of the toe, and will respond differently depending on whether a person hits her toe at the door, or somebody else steps on her toe. Extending this metaphor, a “collectively conscious” organization will respond differently if somebody hits a member purposefully, or if a member hurts her/himself. Similarly to the neurons in the brain that are communicating through their synapses to create consciousness, humans communicate by interacting with each other verbally, through text, or other signals, either face-to-face or over long distance by phone or Internet.

To prove existence of consciousness on the individual level, Descartes famously stated “cogito ergo sum” - I think, therefore I exist. Extending this definition to an organization, “if the organization thinks and acts as one cohesive organism, it exists” and thus shows collective consciousness, defining organizational consciousness as common understanding on an organization’s global context, which allows the members of the organization to implicitly coordinate their activities and behaviors through communication.

As an example of a global level event, in the case of the Boston Marathon bomber, everybody in the Boston area was trying to stay abreast of the most recent developments on Twitter, Facebook and the News, and looking out for traces of the terrorists. On the organizational level, a well-oiled team of software developers working together closely f2f, using chat, or using e-mail trying to debug a jointly developed application also shows a high level of organizational consciousness, as they are able to coordinate their work with minimal use of words.

Our aim is trying to make this implicit understanding more measurable, similarly to brain researchers, who measure individual levels of consciousness by attaching probes to individual neurons, tracking the electrical flow of current flowing through synapses between the neurons. In our work, we measure interaction among people through online media such as e-mail, Twitter, Facebook, and blog posts, applying a framework of “six honest signals of communication” that was introduced previously.

In this blog post I would like to illustrate global consciousness by the example of Francogeddon. On January 15, 2015 financial markets were in turmoil. In a surprise move – later termed Francogeddon - the Swiss National Bank removed the artificial exchange rate of Swiss Franc 1.20 to the Euro, which it had set and defended by buying massive amounts of Euro and Dollars since September 6, 2011. Within hours the exchange rate between Euro and Swiss Franc fluctuated from 1.20 Francs per Euro to 95 cents per Euro, leading to massive losses at stock markets around the world, forcing hedge funds into insolvency.

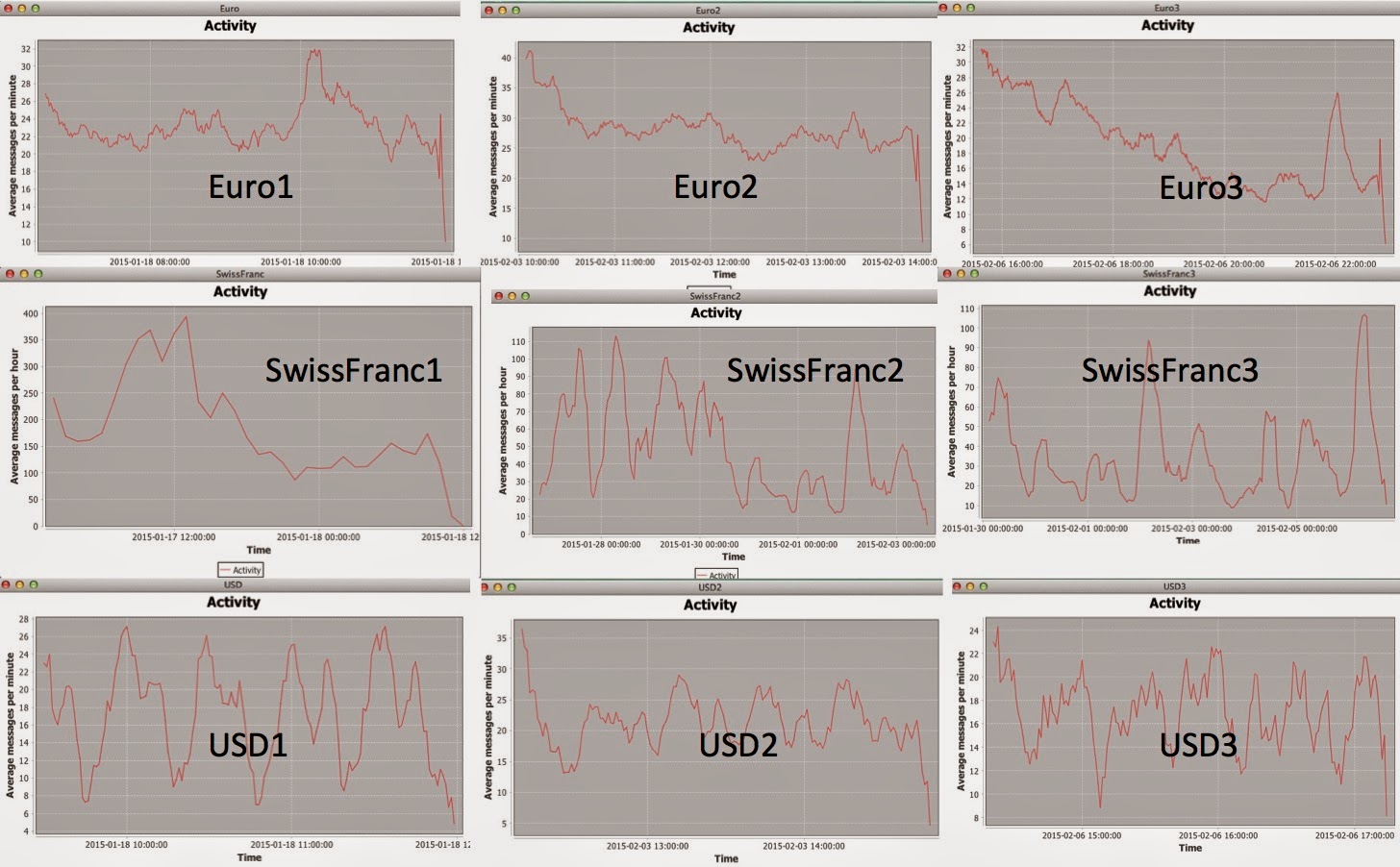

Such an unexpected event at the financial markets offers a unique natural experiment to measure global consciousness of financial markets. Using Condor, I collected the most recent 12,000 tweets containing the string “Swiss Franc”, as well as another 12,000 tweets each containing “Euro” and “USD” on January 18, when Francogeddon was still a major issue, and currencies were still fluctuating wildly. I repeated the data collection at two later points in time, on February 3 and February 6, 2015, when Francogeddon was over, and things had settled down. This 9-part dataset allows me to compare a moment of high public consciousness, when Francogeddon was at the top of everybody’s minds involved into currency trading with a baseline of two later points in time when the event was over and public consciousness should be low again.

To prove existence of consciousness on the individual level, Descartes famously stated “cogito ergo sum” - I think, therefore I exist. Extending this definition to an organization, “if the organization thinks and acts as one cohesive organism, it exists” and thus shows collective consciousness, defining organizational consciousness as common understanding on an organization’s global context, which allows the members of the organization to implicitly coordinate their activities and behaviors through communication.

As an example of a global level event, in the case of the Boston Marathon bomber, everybody in the Boston area was trying to stay abreast of the most recent developments on Twitter, Facebook and the News, and looking out for traces of the terrorists. On the organizational level, a well-oiled team of software developers working together closely f2f, using chat, or using e-mail trying to debug a jointly developed application also shows a high level of organizational consciousness, as they are able to coordinate their work with minimal use of words.

Our aim is trying to make this implicit understanding more measurable, similarly to brain researchers, who measure individual levels of consciousness by attaching probes to individual neurons, tracking the electrical flow of current flowing through synapses between the neurons. In our work, we measure interaction among people through online media such as e-mail, Twitter, Facebook, and blog posts, applying a framework of “six honest signals of communication” that was introduced previously.

In this blog post I would like to illustrate global consciousness by the example of Francogeddon. On January 15, 2015 financial markets were in turmoil. In a surprise move – later termed Francogeddon - the Swiss National Bank removed the artificial exchange rate of Swiss Franc 1.20 to the Euro, which it had set and defended by buying massive amounts of Euro and Dollars since September 6, 2011. Within hours the exchange rate between Euro and Swiss Franc fluctuated from 1.20 Francs per Euro to 95 cents per Euro, leading to massive losses at stock markets around the world, forcing hedge funds into insolvency.

Such an unexpected event at the financial markets offers a unique natural experiment to measure global consciousness of financial markets. Using Condor, I collected the most recent 12,000 tweets containing the string “Swiss Franc”, as well as another 12,000 tweets each containing “Euro” and “USD” on January 18, when Francogeddon was still a major issue, and currencies were still fluctuating wildly. I repeated the data collection at two later points in time, on February 3 and February 6, 2015, when Francogeddon was over, and things had settled down. This 9-part dataset allows me to compare a moment of high public consciousness, when Francogeddon was at the top of everybody’s minds involved into currency trading with a baseline of two later points in time when the event was over and public consciousness should be low again.

The 9 charts above illustrate the activity of the tweeters

on these three days. While the tweet activity about Euro and USD is about the

same on all three sampling days (20 to 30 tweets per minute), tweet activity

for Swiss Franc is about 200 tweets pro hour on January 18, dropping to 50

tweets per hour on February 3 and 6.

The picture below shows the network structure of the three currency

twitter networks on January 18 and February 6. Each node is a person tweeting,

a link is added between two nodes if one person is mentioned in the other’s

person tweet, or one person is retweeting the other person.

As this picture illustrates the tweets about Swiss Franc on

January 18 form a large connected component. The Euro network (which was more

influenced by the Swiss Franc) shows a somewhat smaller connected component,

while the USD tweet network is very little connected which tells us that the

tweeters have nothing to do with each other. On February 6 all three tweet

networks have similar structures of mostly unconnected tweets with the Euro still showing a somewhat larger

connected component.

The Word Clouds for the 6 networks depicted in the picture

below show what people are tweeting about.

While the sentiment about the Swiss Franc on January 18 is

overarchingly negative (the darker the red of a keyword, the more negative its

context), it is somewhat negative for the Euro tweets, and almost exclusively

positive for the USD. The Swiss Franc

tweets on February 6 are becoming more positive, but still mostly negative, as a lot of people

in Eastern Europe, particularly in Poland, but also in Rumania and Austria, complain about taking out mortgages in Swiss Franc, which now ballooned against their local currency.

A look at the USD tweets on both January 18 and February 6 shows that they

mostly consists of retweets of items auctioned on eBay. This illustrates that

the US tweeters don’t care much about Francogeddon. Tweets

about the Euro are somewhat negative, but the concerns – which are growing on

February 6 – are more about Draghi and the possible Grexit, i.e. the exit of

Greece from the Eurozone.

So let’s now look at the six honest signals of communication calculated for the nine datasets:

(1) Group betweenness centrality (how centralized are the

tweet networks), (2) oscillation in group betweenness centrality (how much is

the centrality of individual tweeters in the network changing over time, measured

in 15 minute intervals), (3) average weighted variance in contribution index,

i.e. how much are individual tweeters being retweeted over time, (4) average

response time and nudges, which tells

how long it takes for a tweet to be retweeted, and if people are mutually

retweeting each other, (5) sentiment and emotionality, which shows how positive

and negative the tweets are, and (6) complexity of language.

The charts below illustrate the changes over the three points in time in emotionality, average response time (ART), and number of nudges per tweeter.

For example, the response time (ART) drops considerable for USD from January 18

(day 1) to February 6 (day 3), while it goes up for Swiss Francs. This means

things are cooling down for tweets about Swiss Francs, and it takes more time

until they are retweeted.

Comparing the six honest signals of communication for the

three currencies, we see that even for this small sample, using the

Mann-Withney U-Test, tweeting behavior about Swiss Franc is different from

tweeting about Euro and USD with regards to the number of nudges until one

tweeter responds to another tweeter.

To put this in other words: comparing the three twitter

networks about the three currencies over three points in time, there seems to be higher global

consciousness by people tweeting about Swiss Franc compared to people tweeting about Euro and USD – maybe a

glimpse of global consciousness of currency traders related to Francogeddon?

Comments

Post a Comment