Emotions Draw Close Friends: Analyzing the Social Network Structure of Facebook Fan Pages

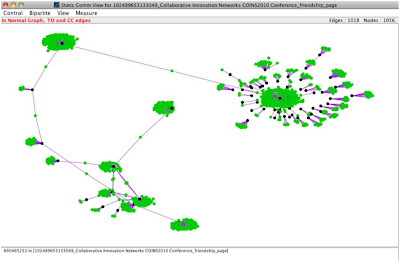

Recently we were wondering if the social network structure of fans of a brand, a star, or a cause tells us how passionate the fans are. To be more precise, we were looking at the network structure of the friendship network of Facebook fan pages. This means that we collected – as far a publicly accessible – the friendship network of the people who clicked on the “like” button on a fan page. For a start, look at the fan page of our own COINs2010 conference (by the way, the conference will be soon in Savannah Oct 7 to 9, at SCAD, we hope to see many of you there ☺ ). The dark dots in the network are the fans of COINs2010, the green dots are their friends. This means that for this initial analysis we looked at how many and how well-connected friends a fan of COINs2010 has. We ignored direct links between the fans, but focused on their external friendship network. In this first attempt we looked at a total of 15 fan groups in 5 categories, see the table below: We (admittedly subjectively